ODFI and RDFI Workshops

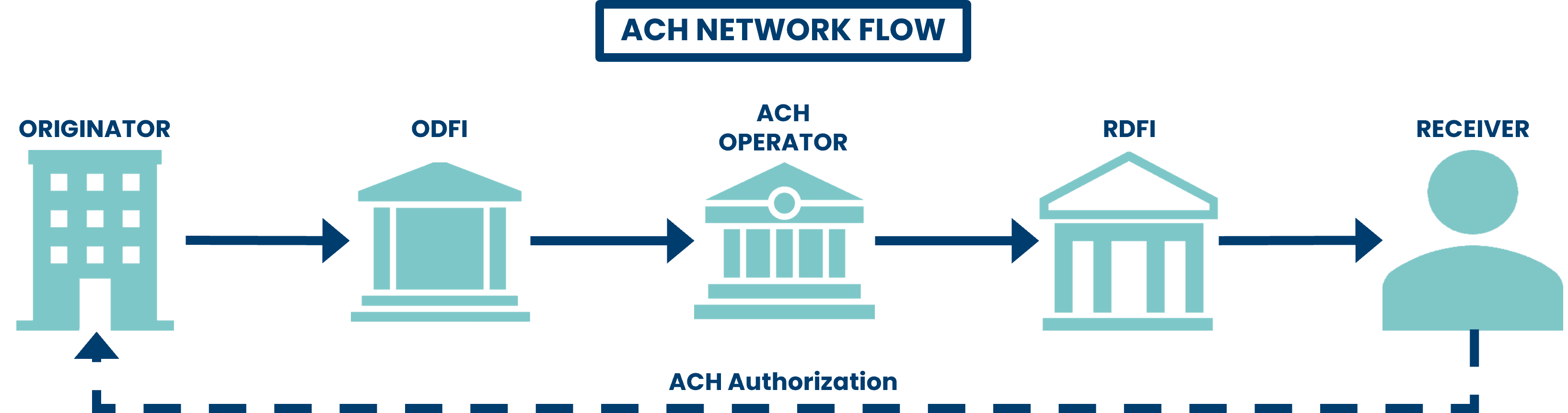

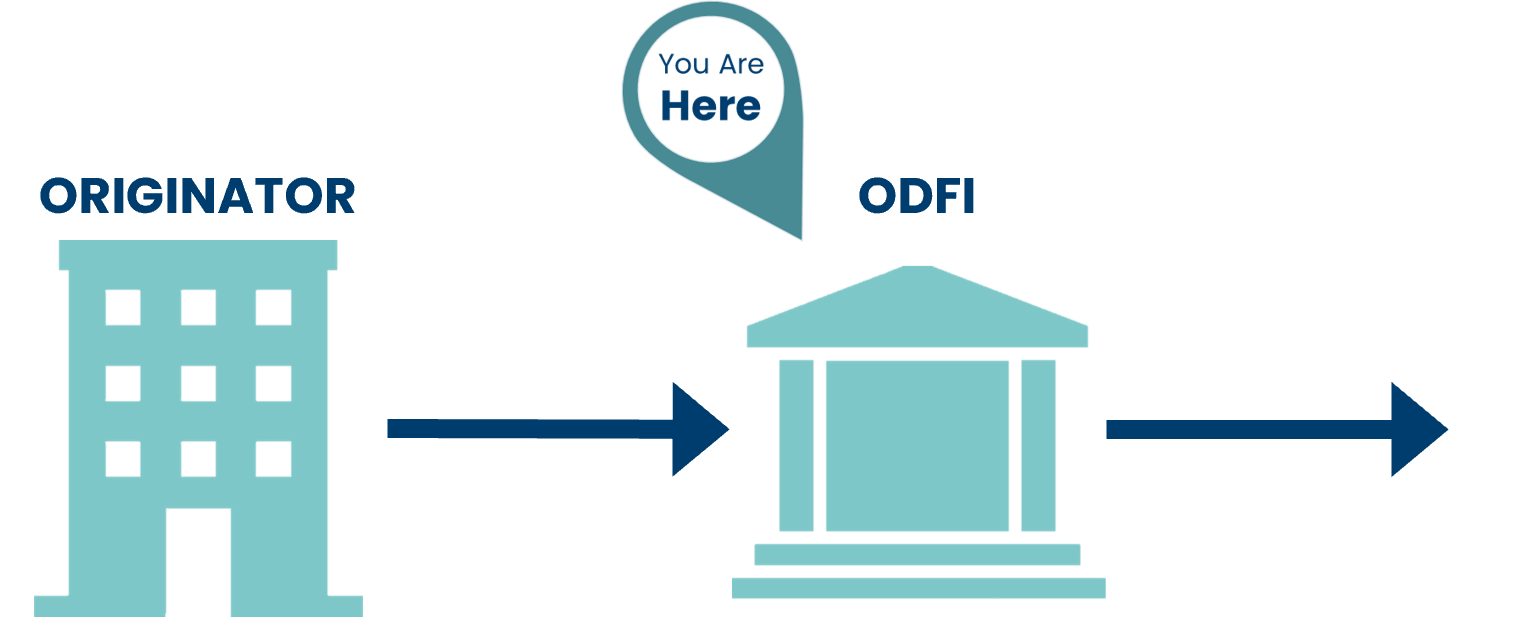

An ODFI is the institution that receives the payment instructions from Originators and forwards the entries to the ACH Operator. A Depository Financial Institution may participate in the ACH Network as an RDFI without being an ODFI; however, if a DFI chooses to originate ACH entries, it must also agree to act as an RDFI.

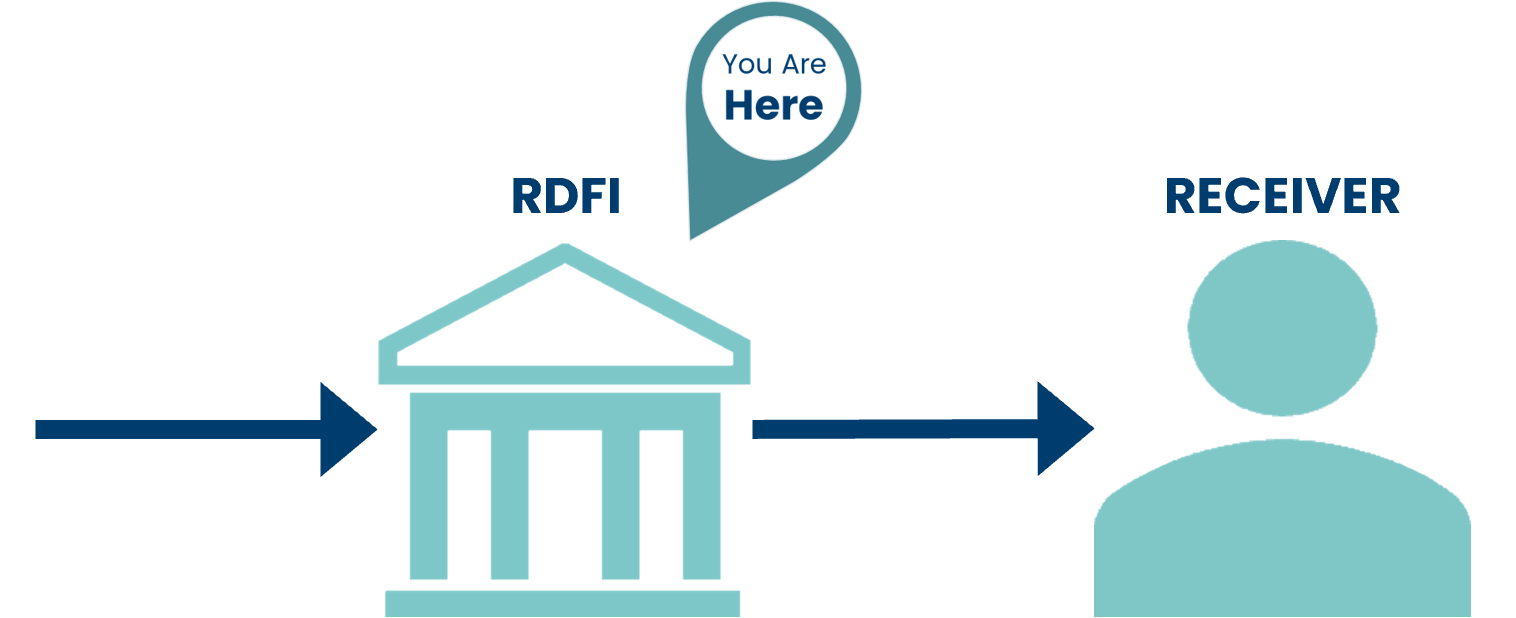

An RDFI is the Depository Financial Institution that receives ACH entries from the ACH Operator and posts them to the accounts of its depositors (Receivers).

Collectively, these financial institutions are critical in the facilitation of secure and efficient ACH transfers between accounts. Their compliance with Nacha Rules ensures the integrity, speed, and reliability of the network, while their participation promotes broader access to financial services and fosters innovation in digital payments across the banking ecosystem.

UMACHA is here to help you learn more about each type of Participating DFI & their many responsibilities under the Nacha Rules. Click the registration buttons below to learn more about each upcoming workshop.

*Agenda, speakers, & session topics subject to change.

ODFI Operations and ACH Origination Workshop

Tuesday, February 24, 2026

9:00 AM - 3:00 PM CT | Virtual

6.0 AAP/AFPP/APRP CECs

$350/$700 (Mbr./Non-Mbr.)

12 Education Club Tokens

RDFI Operations and ACH Receipt Workshop

Tuesday, February 3, 2026

9:00 AM - 3:00 PM CT | Virtual

6.0 AAP/AFPP/APRP CECs

$350/$700 (Mbr./Non-Mbr.)

12 Education Club Tokens