Fraud Forums

About the Fraud Forums:

Fraud continues to evolve — and staying ahead requires collaboration, insight, and shared experience. This in-person information-sharing event brings together local law enforcement, guest speakers, and your industry peers for an interactive discussion focused on fraud awareness, prevention, and response.

Attendees will gain practical insights into current financial crimes impacting institutions in your state, along with actionable strategies to strengthen fraud mitigation efforts. The exact agenda will be announced closer to the event, so be sure to check back for the latest updates.

Key Takeaways — You’ll Learn How To:

- Identify current fraud trends and challenges affecting financial institutions

- Apply practical prevention and response strategies through peer and expert insights

- Engage effectively with law enforcement during fraud investigations

- Leverage tools and resources from UMACHA, FRPA, and Nacha to enhance your institution’s defenses

About the Optional Networking Events:

With recently implemented Nacha Operating Rule revisions and several approved but not yet effective changes, financial institutions face a lot to keep up with to remain compliant.

"Staying Ahead of Nacha Rules: Peer Insights and Practical Preparation" is an in-person, half-day session taking place the morning after each Fraud Forum and will cover key upcoming topics, including fraud monitoring by Originators, TPSPs, and ODFIs, RDFI ACH credit monitoring, new mandatory Company Entry Descriptions, changes to funds availability requirements for certain ACH credits, updates to International ACH Transactions (IATs), and a new return reason code.

In addition to reviewing these updates, attendees will have the opportunity to share insights and learn from peers about how their institutions are preparing for these changes.

Key Takeaways — You’ll Learn How To:

- Understand upcoming Nacha Operating Rules changes and their potential impact on your institution

- Identify steps your institution can take to prepare for the new requirements

- Strengthen compliance and risk management practices in anticipation of upcoming Nacha Operating Rules

| Members & Non-Members | ||||

| 1st Reg. | Each Add'l Reg. | |||

| Fraud Forum ONLY - Register More Than Seven Days Prior to Start | $350 | $175 | ||

| Fraud Forum ONLY - Register Seven Days or Fewer Prior to Start | $375 | $200 | ||

| Fraud Forum ONLY - Cost in Education Club Tokens | 12 tokens | 6 tokens | ||

| Fraud Forum + Networking Event - Register More Than Seven Days Prior to Start | $525 | $262.50 | ||

| Fraud Forum + Networking Event - Register Seven Days or Fewer Prior to Start | $550 | $287.50 | ||

| Fraud Forum + Networking Event - Cost in Education Club Tokens | 18 tokens | 9 tokens | ||

| Continuing Education Credits | TBD | |||

Please visit our Services Policies webpage for more information on Event Policies.

NOTE: During registration for the Fraud Forum, registrants will have the option to add on an additional networking event that will take place the day after each location's Fraud Forum. Click on a registration button below to learn more.

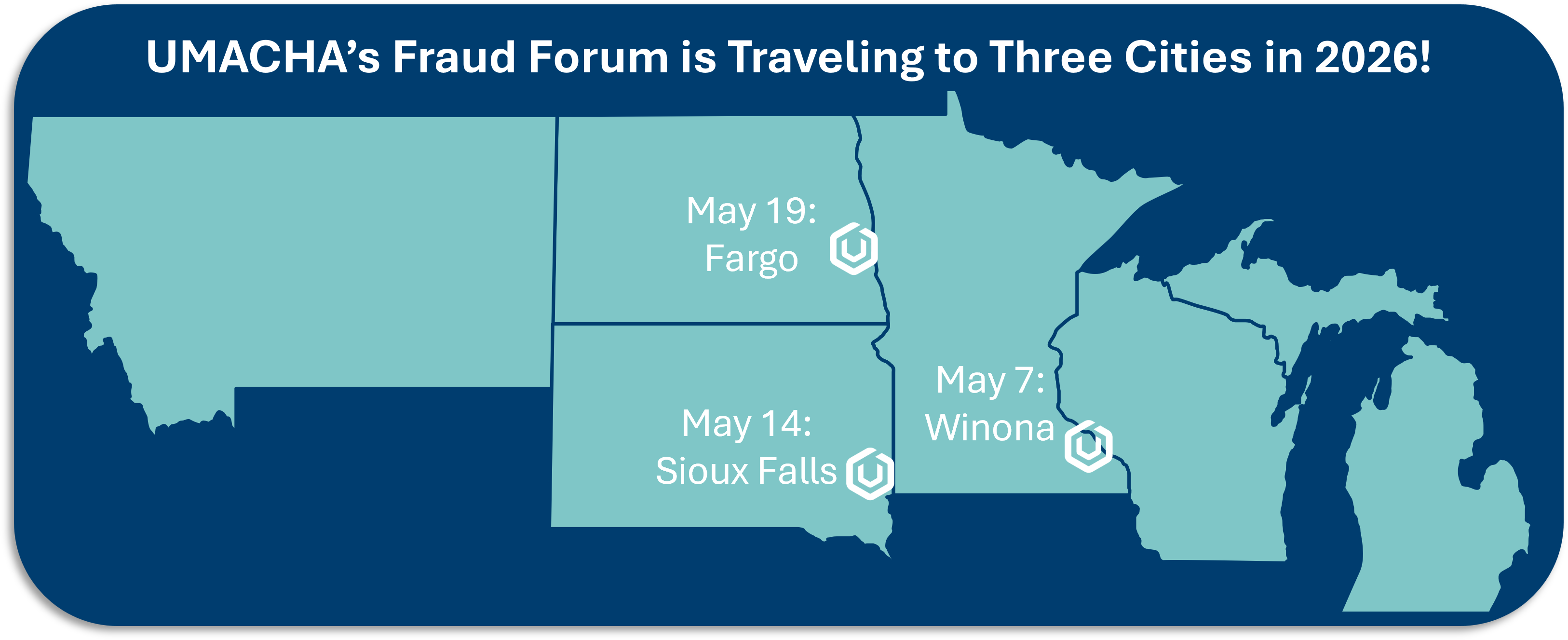

Minnesota/Wisconsin Fraud Forum

Thursday, May 7, 2026

9:00 AM - 3:00 PM CT | In-Person

Winona, Minnesota

South Dakota Fraud Forum

Thursday, May 14, 2026

9:00 AM - 3:00 PM CT | In-Person

Sioux Falls, South Dakota

North Dakota Fraud Forum

Tuesday, May 19, 2026

9:00 AM - 3:00 PM CT | In-Person

Fargo, North Dakota