With digitalization and instant payments rapidly evolving the payments landscape, now is the time to leverage momentum and catalyze innovation in the way businesses exchange invoices, payments and remittance information with one another. To accelerate this evolution, the Business Payments Coalition, with support from the Federal Reserve, recently launched two work groups to assess and pilot efforts to drive more efficient business-to-business (B2B) payment processes and ultimately achieve straight-through processing (STP).

STP for businesses refers to when the entire payment process including invoice, payment and remittance information is completely automated from start to finish. These electronic or automated payment processes benefit the entire B2B payments ecosystem as they lead to more efficient payments.

In today’s current B2B payments environment, the buyer and supplier must complete a manual action at one or more points in the process. Prone to fraud and data entry errors, these manual processes result in increased time and overall cost for processing an electronic payment. Further, manual processes prevent transparency of payment status, making it difficult for the buyer and supplier to know whether the invoice was paid on time, late, paid in full or partial, or if a discount was applied. These costs and inefficiencies in the current B2B payments process highlight the value of STP of B2B payments and supporting information, yielding risk mitigation, cost savings, operational efficiency and deeper insights.

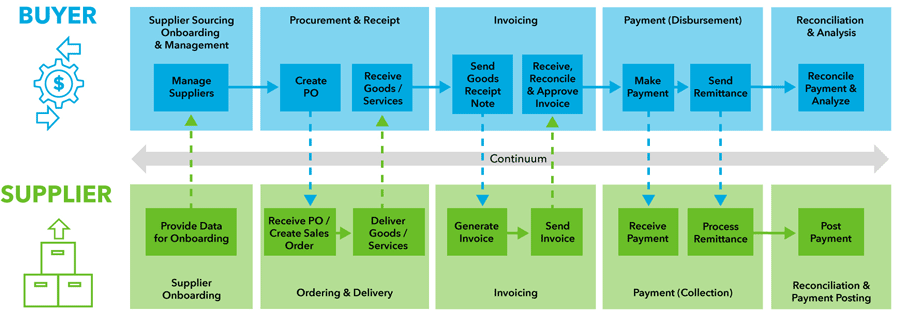

STP is achieved by establishing an electronic payment process that requires no manual intervention. The graphic below provides a visual overview of the automated processing of a B2B payment, depicting the steps that take place across the continuum between businesses. The first column represents a one-time supplier onboarding process step, while the individual steps in the payment process begin at the second column with procurement and receipt. Further, the dotted arrows depict whether the buyer or supplier is initiating the action in the automated process.

Saving Time, Reducing Costs and Mitigating Risks with Straight-Through Processing for B2B Payments

Alleviating the pain points that result from manual processes, this automated continuum yields multiple benefits for businesses. In particular, businesses that utilize an electronic exchange framework, where supporting payment information is shared electronically without manual intervention, yield more timely payments, enhanced cash management and improved payment application. While the payment information is shared through the exchange framework, the payment itself travels through the payment rail or system.

STP of invoices and remittance information, in support of electronic payments maximizes efficiency at each point in the continuum of the B2B payments process, radically transforming the way businesses exchange and process information required to effectively process payments with one another. And by leveraging modernized payment processes, businesses of all types gain from the transformation and efficiency that an automated continuum process brings.To learn more, join the FedPayments Improvement Community

(select “E-invoicing” and “Electronic Payments and Remittance” under the interest preferences), and follow FedPayments Improvement on LinkedIn (Off-site) and Twitter (Off-site).