A Look at Check Trends in 2025

Published on January 10, 2025

AUTHOR

Eric Wester, AAP, APRP, NCP

Associate Director of Education Services

Checks have been a cornerstone of financial transactions for centuries, offering a simple and secure way to transfer money. Despite the rise of digital payment methods, checks remain a widely used tool in both personal and business finances. However, as payment trends evolve, so do the risks associated with fraud. In this blog, we’ll explore the current trends in check volume, examine the concerning rise in check fraud, and provide resources to help you inform your customers, members, friends, and family about spotting, avoiding, and reporting check-related scams.

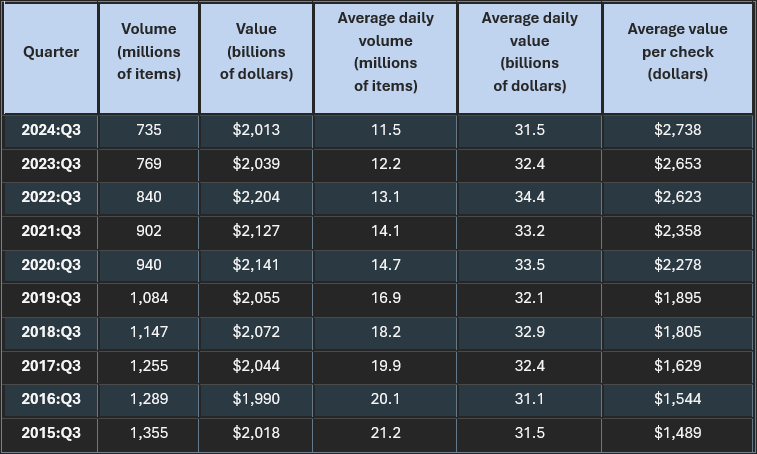

Trends in Check Volume

The exact number of checks written each year can be difficult to determine because financial institutions use various exchanges to clear checks, including private exchanges where the number of checks exchanged may not be included in data provided by the Federal Reserve. However, reviewing commercial check volumes handled by the Federal Reserve offers valuable insight into overall industry trends.

In the third quarter of 2024, the most recent quarter with publicly available statistics, the Federal Reserve processed 735 million checks. This represents a 2.5% decrease from the previous quarter and marks the lowest quarterly volume of checks processed since the earliest available data from 1989.

Source: Board of Governors of the Federal Reserve System, accessed January 8, 2025

While comparing check volumes from the third quarter over the past ten years, we observe a consistent and expected downward trend in the number of checks processed. In contrast, the average value per check continues to trend upward, possibly reflecting a combination of factors, including inflation and business-to-business check payments accounting for more of the check volume and value than consumer check payments.

Check Fraud Remains an Ongoing Issue

The United States Department of the Treasury established mail theft-related check fraud as a concern, and FinCEN issued the Alert on Nationwide Surge in Mail Theft-Related Check Fraud Schemes Targeting the U.S. Mail, FIN-2023-Alert 003 (off-site), on February 27, 2023. In the six months that followed, FinCEN examined BSA reports that used the February 2023 Mail Theft-Related Check Fraud Alert key term filed during the review period to determine trends. During the review period, FinCEN received 15,417 BSA reports related to mail theft-related check fraud associated with more than $688 million in transactions, which may include both actual and attempted transactions.

According to a September 2024 Financial Trend Analysis (off-site), “FinCEN identified three primary outcomes from perpetrators after stealing checks from the U.S. Mail: (1) altering and depositing the checks, (2) using the stolen checks to create counterfeit checks, and (3) fraudulently signing and depositing the checks. The methodologies that criminals use to perpetrate these outcomes can range from unsophisticated to highly organized and complex, often involving the use of advanced counterfeit check technology and chemicals that can remove ink from stolen checks.”

The analysis also concluded that perpetrators of check fraud generally use methods that avoid direct human contact, such as mobile deposit and other forms of remote deposit capture, including ATM deposits. FinCEN also noted that check fraud is a national problem affecting many financial institutions, as BSA reports were received from every U.S. state, as well as Washington, D.C., and Puerto Rico.

Finally, the analysis described several methodologies used for perpetrated check fraud:

Unsophisticated methodologies

-

Examples include a bad actor signing their name on the back of a check and attempting to deposit it, making alterations to the payee listed on the check, and making it appear the intended payee had signed the check over to the bad actor.

Moderately sophisticated methodologies

-

Examples include a bad actor using chemicals to remove the original ink and replacing the payee with someone else (i.e. check washing), selling a copy of the check on dark web marketplaces, using the MICR line information to create counterfeit checks, and stealing newly ordered blank checks from the mail and forging the rightful account holder’s signature.

Sophisticated methodologies

-

Examples include a bad actor opening a new account, oftentimes online, with the intention to use the account for negotiation of stolen checks, using romance and employment scams to convince a victim to negotiate a check and send the proceeds elsewhere, and USPS insider fraud.

Despite the volume of checks decreasing, check fraud is not expected to decrease in 2025. John Fick (off-site), Corporate Vice President, Head of Fraud at Northwest Bank states "Generative AI can analyze genuine check samples and produce countless counterfeits in a matter of minutes, which can then be printed using standard home printers. Gone are the days when synthetic identities (off-site) were primarily pollinating through credit cards or loans. Today, they are being paired with tangible monetary instruments like counterfeit checks tailored to match the fake identity. As this trend grows, fraudsters are poised to unleash widespread disruptions, exacerbating challenges in an already volatile economy."

How to Spot, Avoid, and Report Fake Check Scams

As payments professionals, we are in an excellent position to educate our customers, members, friends, and family on how to protect themselves by spotting, avoiding, and reporting fake check scams.

The Federal Trade Commission (FTC) provides an educational resource (off-site) that helps consumers learn more about these scams, including the different types of fake check scams, how these scams work, why someone might have access to funds before a check is returned unpaid, how to avoid fake check scams, what to do if they have already sent money to a scammer, and how to report fraud.

Upcoming Education Offerings from UMACHA

As your key partner in helping you understand all things electronic payments, UMACHA is pleased to offer several upcoming events that may be of interest to you. Consider joining us for the following:

-

Webinar: ‘Check Exceptions: Returns, Adjustments, & Claims’ on January 28th

-

Workshop: ‘Check Operations Workshop (Virtual)’ on January 29th

-

Webinar: ‘The Payments Roundtable’ on January 30th

You can also find previously recorded sessions in our on-demand webinar library where you can purchase and watch a webinar on your time.

Stay connected with Eric Wester and UMACHA on LinkedIn!