ENR Entries: What Are They, and Why Are We Suddenly Hearing About Them?

Published on June 16, 2025

AUTHOR

Eric Wester, AAP, AFPP, APRP, NCP

Associate Director of Education Services

For 17 years in the banking industry, I never once received a question about ENR Entries. They were an obscure footnote in the world of ACH—used occasionally, understood by few, and rarely discussed. But over the past month, that’s changed dramatically. At UMACHA, we’ve suddenly started receiving multiple inquiries each week about ENR (Automated Enrollment) Entries—what they are, how they work, and why they seem to be coming up more frequently. So, what’s behind this sudden surge in interest? In this blog, we’ll break down what ENR Entries are, when and why they’re used, and what might be driving this newfound attention.

What Are ENR Entries?

Before we go any further, let’s do a bit of level setting. Every ACH Entry includes a three-character code known as the Standard Entry Class (SEC) Code. This code helps define the type and purpose of the transaction. ENR is one of those SEC Codes. Specifically, ENR stands for Automated Enrollment Entry.

ENR provides a method for financial institutions to use the ACH Network to submit Direct Deposit enrollment information to federal agencies for benefit payments. An ENR Entry is a non-monetary ACH transaction initiated by a financial institution and sent to a participating federal benefit agency as part of the ENR program.

Not all federal agencies participate in the ENR enrollment method. However, several major paying agencies do, including the Social Security Administration (for Social Security benefits, disability, and SSI payments), the Office of Personnel Management (Civil Service annuity), the Railroad Retirement Board (RRB annuity), and the Department of Veterans Affairs (VA benefits).

The most common use cases for ENR Entries involve helping federal benefit recipients transition their payments to Direct Deposit. This includes individuals who are still receiving paper checks and want to enroll in Direct Deposit, as well as those who are already receiving their benefits via Direct Deposit but wish to switch to a different financial institution. In cases where a beneficiary wants to move their Direct Deposit from one financial institution to another, it’s the new institution—the one the beneficiary wants to start receiving the funds at—that must submit the ENR Entry, not the institution currently receiving the deposits.

What’s the Risk and What Are the Alternatives to ENRs?

The Green Book (off-site) states, “Errors in the Direct Deposit enrollment process are the primary cause of misdirected payments. Financial institutions will be held liable for providing incorrect enrollment information and should, therefore, carefully review all Direct Deposit enrollment procedures.”

A financial institution's potential liability for mishandling an Entry is also reinforced in 31 CFR Part 210.8(b), Financial Institutions – Liability (off-site).

If your accountholder is simply looking to move their Direct Deposit from one account to another within your financial institution, such as closing an account due to fraud and opening a new one, the change can typically be handled through the Notification of Change (NOC) process.

However, if a Social Security beneficiary wants to move their Direct Deposit from one financial institution to another, they can use one of the alternative methods provided by the Social Security Administration (off-site):

-

Make the change online (off-site) through their Social Security account.

-

Set up an appointment with Social Security to update their Direct Deposit information by calling 800-772-1213 and telling the representative they want to update their Direct Deposit.

Federal benefit recipients who are currently receiving their payments by paper check can enroll in Direct Deposit by visiting the Go Direct website at GoDirect.gov (off-site). This platform provides a simple and secure way to make the switch to electronic payments.

Additionally, U.S. Department of Veterans Affairs (VA) beneficiaries can manage their Direct Deposit information online here (off-site), and changes for the U.S. Office of Personnel Management (OPM) can be made online here (off-site). U.S. Railroad Retirement Board (RRB) Direct Deposit information can be updated by the beneficiary contacting their local RRB field office (off-site).

For more detailed information about Direct Deposit enrollment for federal benefits, financial institutions can refer to Chapter One of the Green Book. Ultimately, each institution must make a risk-based decision about whether to originate ENR Entries or instead recommend other methods, such as online enrollment or contacting the agency directly, for setting up or updating Direct Deposit instructions.

Why Are We Suddenly Hearing About ENRs?

The ENR Entry isn’t new—in fact, the ENR SEC Code was approved on October 20, 1995, and became effective in September 1996. So, why are we suddenly receiving so many questions about it?

According to the Social Security Administration’s May 1, 2025, blog (off-site), phone support is still available as an option. However, various media outlets have reported that beneficiaries have had trouble reaching federal agencies like Social Security by phone in recent months.

Adding to the growing visibility of ENRs, Social Security has recently started encouraging beneficiaries to ask their financial institutions to submit their Direct Deposit information using the Automated Enrollment (ENR) process.

However, we’ve also heard from UMACHA members who contacted Social Security for help with ENRs, only to be told that the agency was unfamiliar with the process and recommended using another method instead. This disconnect is contributing to confusion and further questions about ENRs—likely one of the reasons they’ve suddenly become such a hot topic.

How Do We Process ENR Entries if We Want To?

Financial institutions looking to begin originating ENR Entries must first confirm that their systems support this functionality. For many institutions, this may involve reaching out to their core provider or other ACH origination service providers to determine whether ENR origination is enabled and available. Financial institutions must have a way to create a Nacha-formatted ACH File containing an ENR Entry and transmit the File to their ACH Operator.

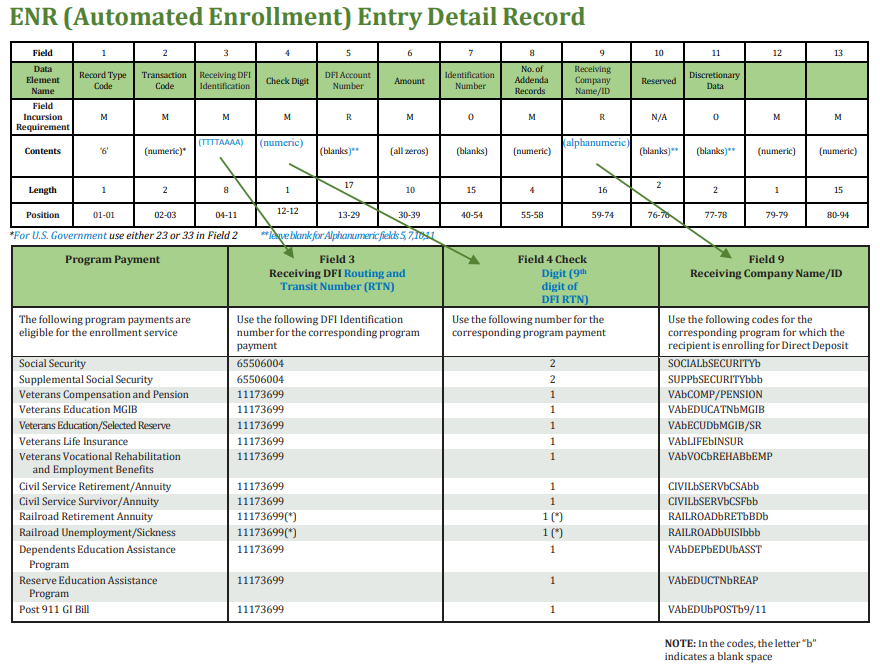

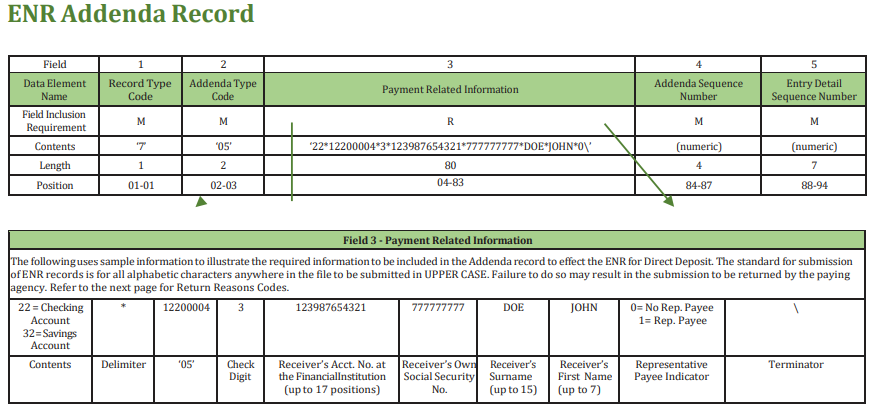

When it comes to formatting ENR Entries correctly, the Green Book offers valuable guidance, including detailed mapping instructions for the required fields in both the Entry Detail Record and the Addenda Record. The following mapping resources can be found on page 1-27 of the Green Book:

(Click to enlarge the above graphic)

(Click to enlarge the above graphic)

In addition to the mapping resources available in the Green Book, you should also refer to the formatting requirements outlined in Appendix Three of the Nacha Operating Rules, which address the required field values for the Amount, Company Entry Description, Effective Entry Date, and more.

Looking for Additional ENR Resources?

Chapter 44 of the Nacha Operating Guidelines is devoted to the ENR Entry and covers several related topics, including:

- Format Requirements

- Responses to Automated Enrollment Entries

- Using a Third-Party Service Provider to Originate Automated Enrollment Entries

- Returned Automated Enrollment Entries

As your key partner in understanding electronic payments, our entire team at UMACHA is here to support you. If you have specific questions about ENRs or any payments-related questions, please feel free to contact us at info@umacha.org or by phone at (763) 549-7000 – it’s all part of your member benefits!

Stay connected with Eric Wester and UMACHA on LinkedIn!