UMACHA & the 1970s

Number of Employees: 1/2

Volunteer-based with one part-time Executive Secretary

The post-World War II Golden Age of America ended in the 1970s with the rise of the "New Right" movement, which promoted free market principles and traditional family values as a reaction to the social and political turmoil of the 1960s. Meanwhile, liberalism gained momentum as people began to focus on environmental conservation in response to the OPEC oil embargo and energy crisis. The economy was plagued by stagflation, a combination of high inflation and unemployment that created an extremely challenging financial environment.

During this decade of division and innovation, the digital age began to take shape. The floppy disk was reduced in size to a 5 inch format, and Apple computers were launched, paving the way for the future of personal computing. The LED (light-emitting diode) debuted, and the video game Pong ushered in the era of eSports. Other notable technological advancements of the time included the Walkman, VCR, and cell phone.

It was during this transformative decade that the modern payment system was first established. It began in 1968 with a group of California bankers’ growing concern over the number of paper checks prompting them to form the Special Committee on Paperless Entries, or SCOPE (which became CACHA).

The efforts of this group, along with the results of an American Bankers Association (ABA) -sponsored study on how to improve the nation’s payment systems, led to the teaming up of four payments associations to create Nacha. These four associations were UMACHA, California ACH Association (CACHA - currently WesPay), Georgia ACH Association (GACHA - currently Payments First) and New England ACH Association (NEACH).

Nacha was originally a part of the ABA and spun off in the mid-80s. The CACHA ACH Rules were transferred and eventually became the Nacha Operating Rules. Nacha became the holder of the rules, as was necessary to make the network national.

1974

UMACHA begins as a volunteer-run, not-for-profit corporation with a part-time Executive Secretary.

UMACHA’s purpose is to provide automated clearing house services for banks in the Ninth Federal Reserve District and to promote more efficient banking practices for its members. UMACHA also conducts educational programs and provides marketing support to its members.

Starting out as an operational automated clearing house, the initial agreements between UMACHA and its members are UMACHA acting as an ACH sending and receiving point to and from the Federal Reserve Bank of Minneapolis.

Both origination and received agreements are signed by members along with settlement agreements. UMACHA established its own rules using the California model in development that members agreed to follow when becoming a member.

The first member Receiving Bank Agreement is signed on 4/26/1974 with First State Bank of Rosemount in Minnesota.

214 banks join UMACHA in its first year as both originating and receiving banks (158 in Minnesota, 3 in Michigan, 18 in North Dakota, 16 in South Dakota, and 16 in Wisconsin).

During the same year UMACHA was established, they were also one of the four first automated clearing houses (later known as regional payments associations), to form the national association to modernize the payments system.

The National Automated Clearing House Association (Nacha) is established as part of the American Bankers Association (ABA). Its primary role being to create an inter-regional exchange so parties in one Association could exchange entries with parties in another Association, with a common set of rules that applied to all.

Virgil Dissmeyer from Northwestern National Bank of Minneapolis, a UMACHA volunteer, played an instrumental role in UMACHA’s start. He was a key participant in the effort to create the national association and served as the second chairman of Nacha.

1976

The national association purchases the rights to the name SurePay - the term coined to describe the debit and credit services that are provided through the ACH.

SurePay replaces the term APEX (Automated Payments Exchange), the term formally used to describe ACH services.

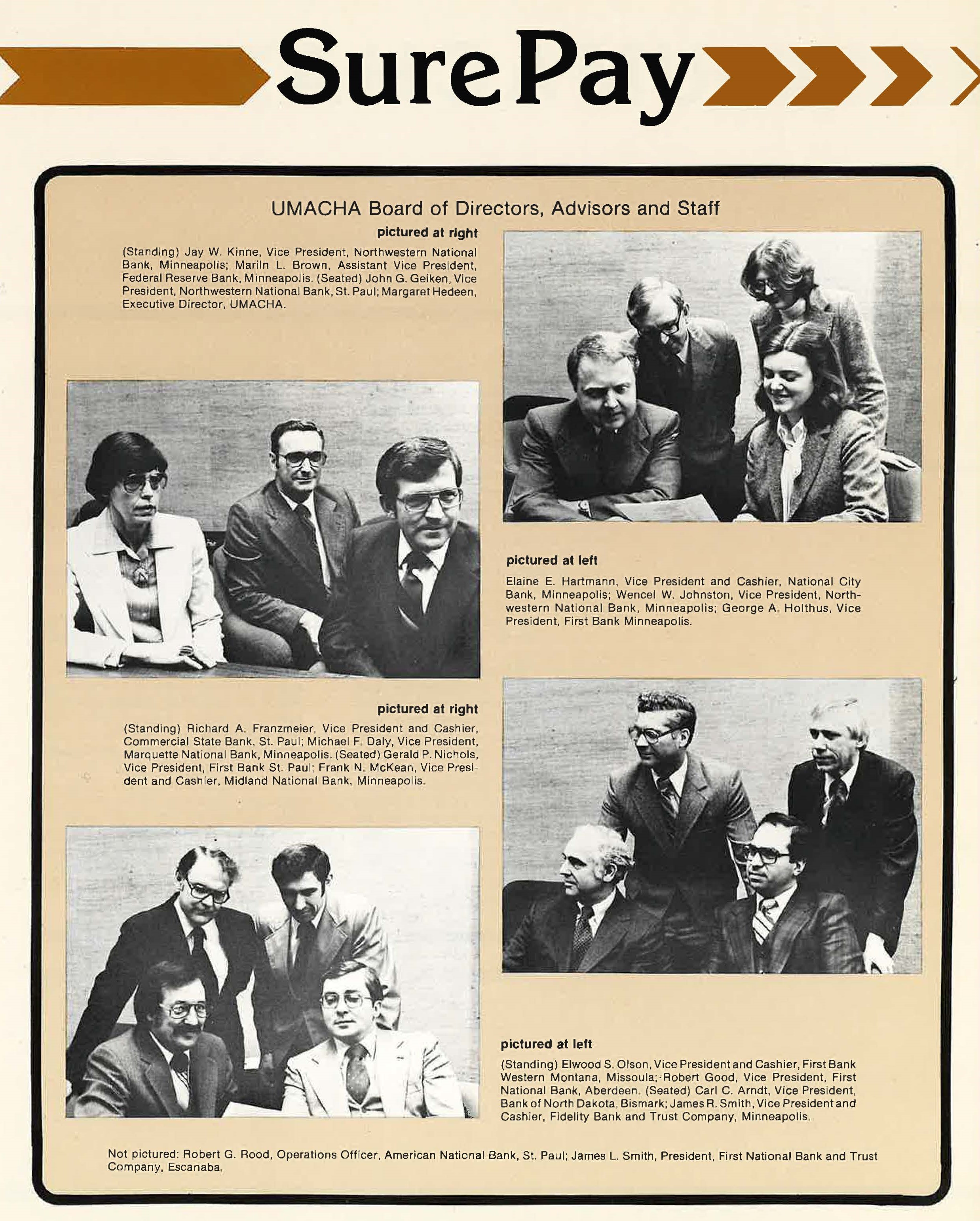

1977

UMACHA begins soliciting membership among financial institutions in the state of Montana and welcomes the First State Bank of Forsyth and Manhattan Bank.

The UMACHA Board of Directors approves the admission of thrifts and credit unions to UMACHA on the same basis as commercial banks.

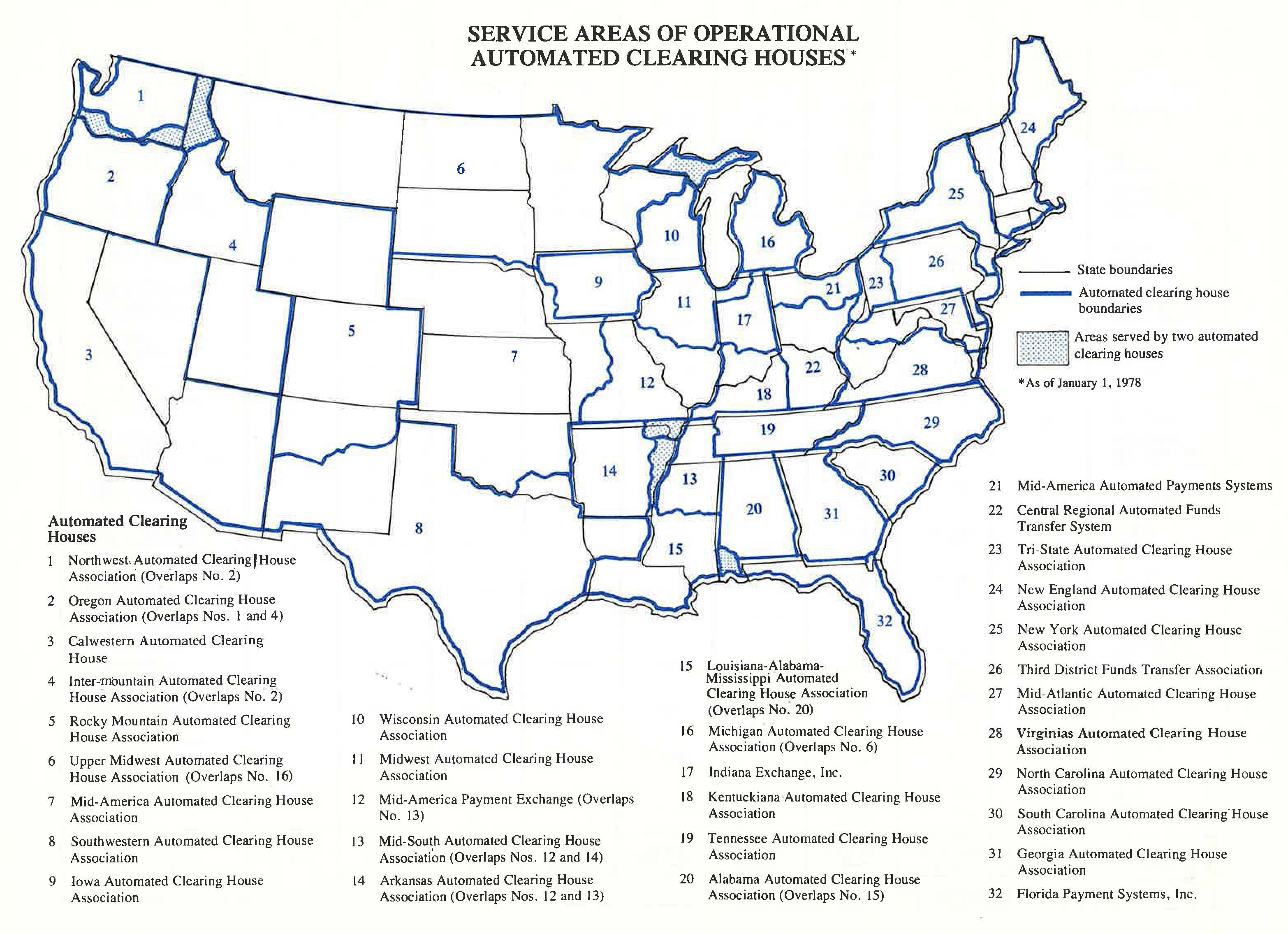

1978

There are 32 Automated Clearing Houses across the country, later known as Regional Payments Associations and now referred to as Payments Associations.

Click an image to expand to full screen.

The first edition of the 1974 UMACHA ACH Rules

UMACHA's first unofficial logo used on its mailed newsletters

Four-page UMACHA newsletter from August 1977

L to R: Dan Walsh - NEACH, Virgil Dissmeyer - Northwestern National Bank (Norwest), Elliot McEntee - NACHA, Russ Fenwick - Bank of America, Jimmy Jarrell - Georgia Federal Bank

UMACHA Board of Directors, Advisors, and Staff

January 1978: Service Areas of the 32 Operational Automated Clearing Houses