UMACHA & the 1980s

Number of Employees: 2

A new conservatism grew in the 80s, led by the similarly inclined U.S. President Ronald Reagan and the Prime Minister of the U.K., Margaret Thatcher. The consumerism-driven decade was impacted by the emergence of the yuppie, the establishment of networks such as CNN and MTV, and a deluge of blockbuster movies. On the flip side, the Cold War, the Iran-Contra Affair, and the AIDS crisis brought fear and trepidation to the forefront.

The financial sector suffered tremendously from the Savings and Loans (S & L) Crisis brought on by the dramatic rise in inflation and interest rates in the late 70s and early 80s. Between 1980 and 1994, more than 1,600 of these smaller, home loan-focused institutions were forced to close their doors. During this same period, specifically 1981 – 1984, 17 mutual savings banks with $24 billion in assets were saved through assisted mergers.

Despite the devastating bank and thrift failures of the 80s, the government remained true to its commitment to protecting insured depositors – no depositors lost any money on federally insured deposits.

1980

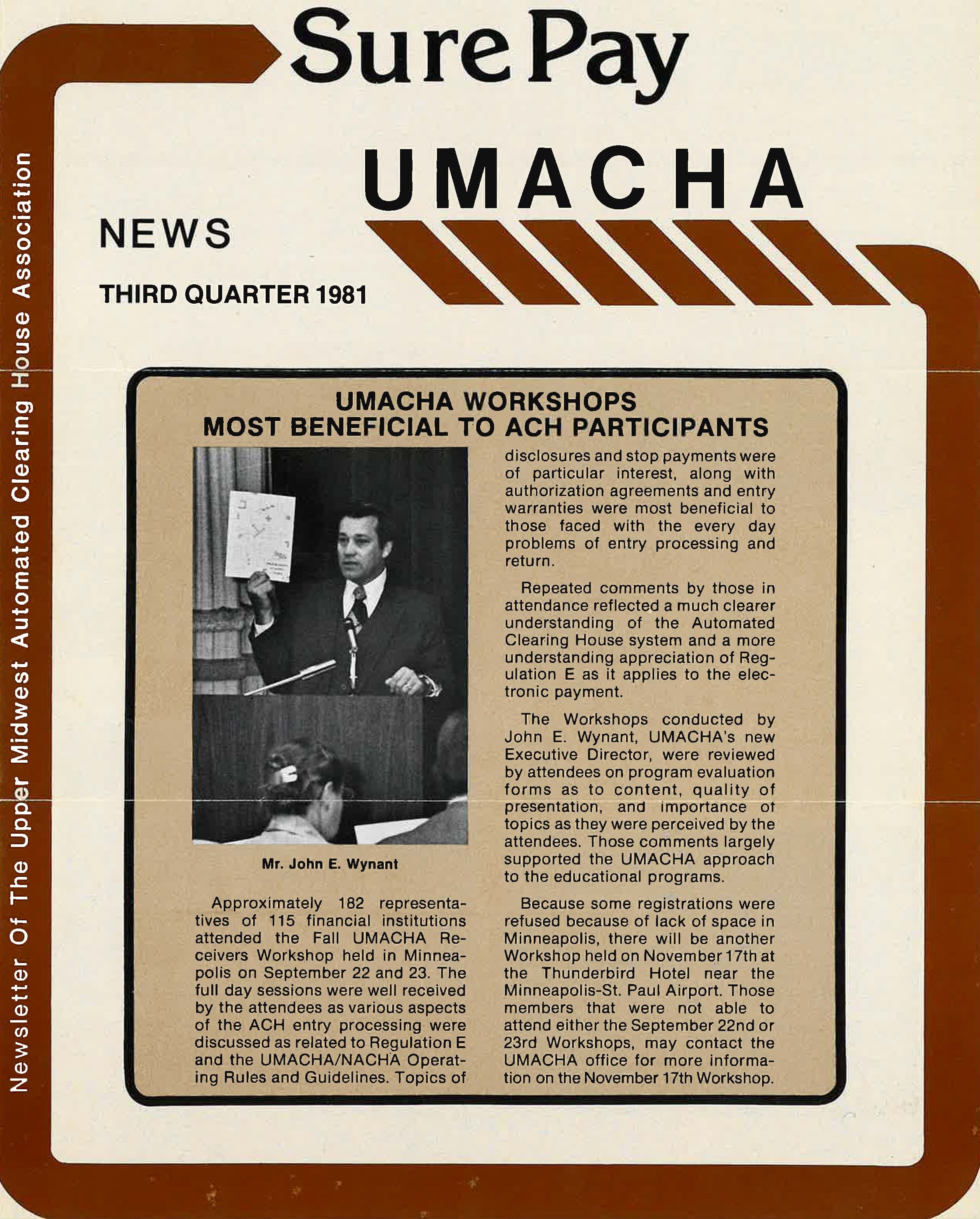

UMACHA hires John E. Wynant as the first Executive Director.

By the early 80s, UMACHA is thriving with over 1,300 member financial institutions including banks, S&Ls, and credit unions.

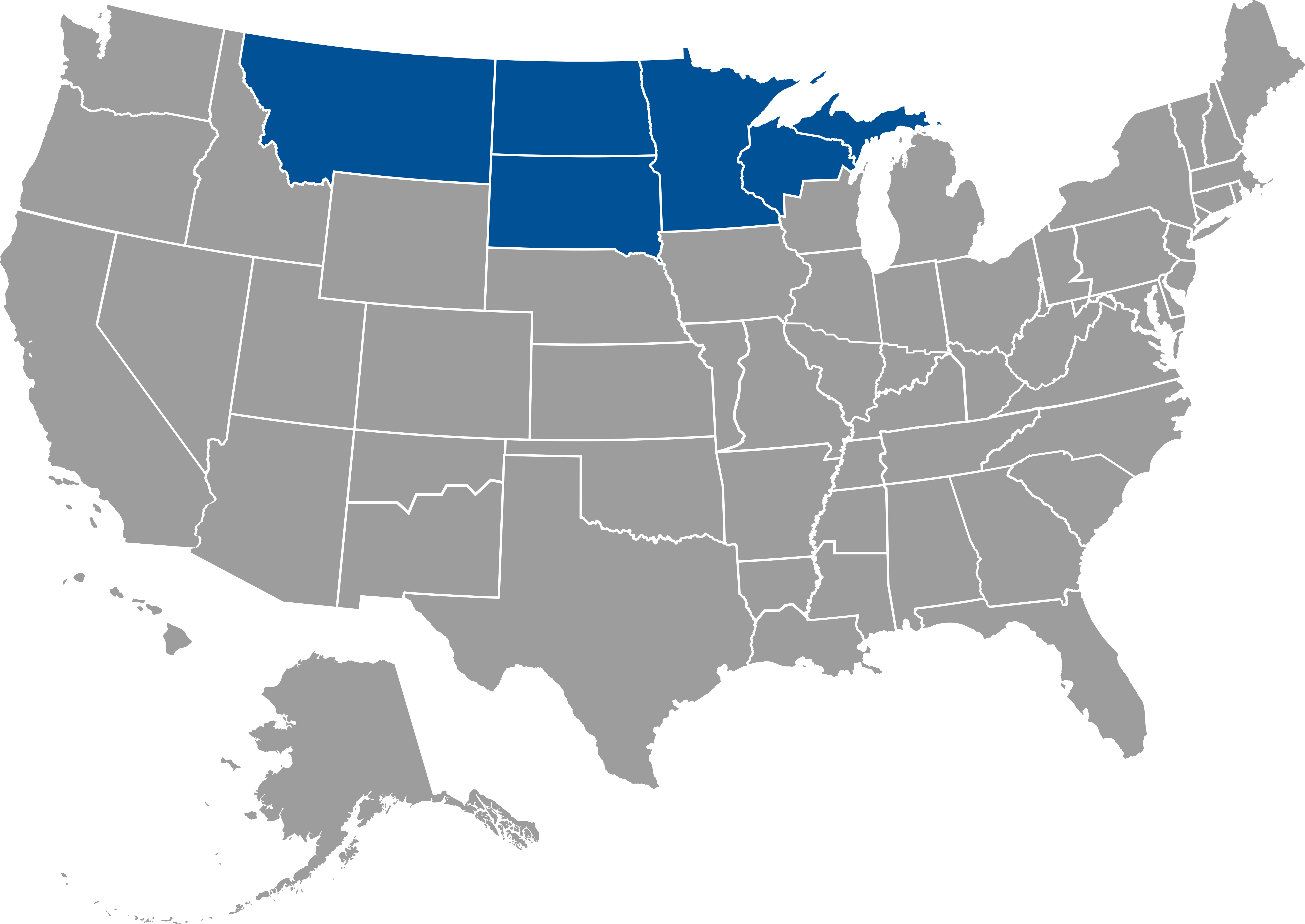

UMACHA’s territory mirrors that of the Ninth Federal Reserve District, which includes Minnesota, North Dakota, South Dakota, Montana, the north and west portions of Wisconsin, and the Upper Peninsula of Michigan.

Photo Source: federalreserve.gov

Learn More About the Ninth Federal Reserve District (off-site)

1984

UMACHA hires Fred Laing II as the second Executive Director. Fred was active with UMACHA since its inception as a member of the Operations and Marketing Committees and Chairman of the Goals Committee.

UMACHA announces a new service for members to send their Notification of Change Forms directly to UMACHA for processing. If the form was destined for another UMACHA member, it was not subject to a charge by the Federal Reserve.

1985

UMACHA holds the first Marketing Conference in partnership with The Federal Reserve. This conference will eventually become known as Navigating Payments.

UMACHA markets a consulting service to members.

The City of St. Paul now has over 3,000 employees. Currently, 600 of those employees have signed up for Direct Deposit, which is up from 500 employees in 1983 and only 250 employees in 1982.

UMACHA redistributed 515 Notifications of Change between other ACHs taking part in the NOC exchange saving members $1,287 in costs.

Slide and sound options are incorporated into UMACHA education.

1986

The United States Postal Service begins utilizing ACH for Direct Deposit of payroll in one of the largest conversions to ACH yet. This conversion results in an additional 280,000 items per month being originated.

1987

UMACHA and the Federal Reserve sponsor an ACH conference directed at ODFIs who want to "Get on the ACH Fast Track." At the time, there were 250 ODFIs within UMACHA, but only 31 of those originated more than 1,000 entries per month.

The U.S. Department of Treasury announces a system to handle automated Notification of Change notices.

The U.S. Department of Treasury deploys a major advertising campaign to promote Direct Deposit. The campaign is targeted to recipients of Social Security payments and Supplemental Security Income benefits. Check out this spot, featuring actress Rita Moreno.

1989

New SEC Code = CTX (Corporate Trade Exchange)

Nacha Rule Amendment: Corporate Trade Exchange (CTX) Entries

- Effective April 10, 1989

- This rule change expanded the Rules to include ANSI standards X12.5 (Interchange Control Structure) and X12.6 (Application Control Structure), in addition to the existing standard X12.4. This amendment enabled information contained within the CTX addenda records to be formatted in a manner consistent with a pure X12 message, thus facilitating the acceptance and processing capabilities of all participants.

Nacha Rule Amendment: RDFI Reliance on Account Numbers for Posting of ACH Entries

- Effective April 10, 1989

- This amendment permitted the RDFI to rely solely on account numbers for the posting of ACH entries. This amendment also required the ODFI to warrant that entries it originates contain the correct account numbers of the Receivers.

Nacha Rule Amendment: Reinitiation of Returned Entries

- Effective April 10, 1989

- This amendment restricted an Originator from reinitiating a return entry unless (1) the entry was returned for insufficient or uncollected funds, (2) the entry was returned for stop payment and the Receiver has authorized the reinitiation of the entry, or (3) corrective action has been taken by the Originator to remedy the reason for the return.

Click an image to expand to full screen.

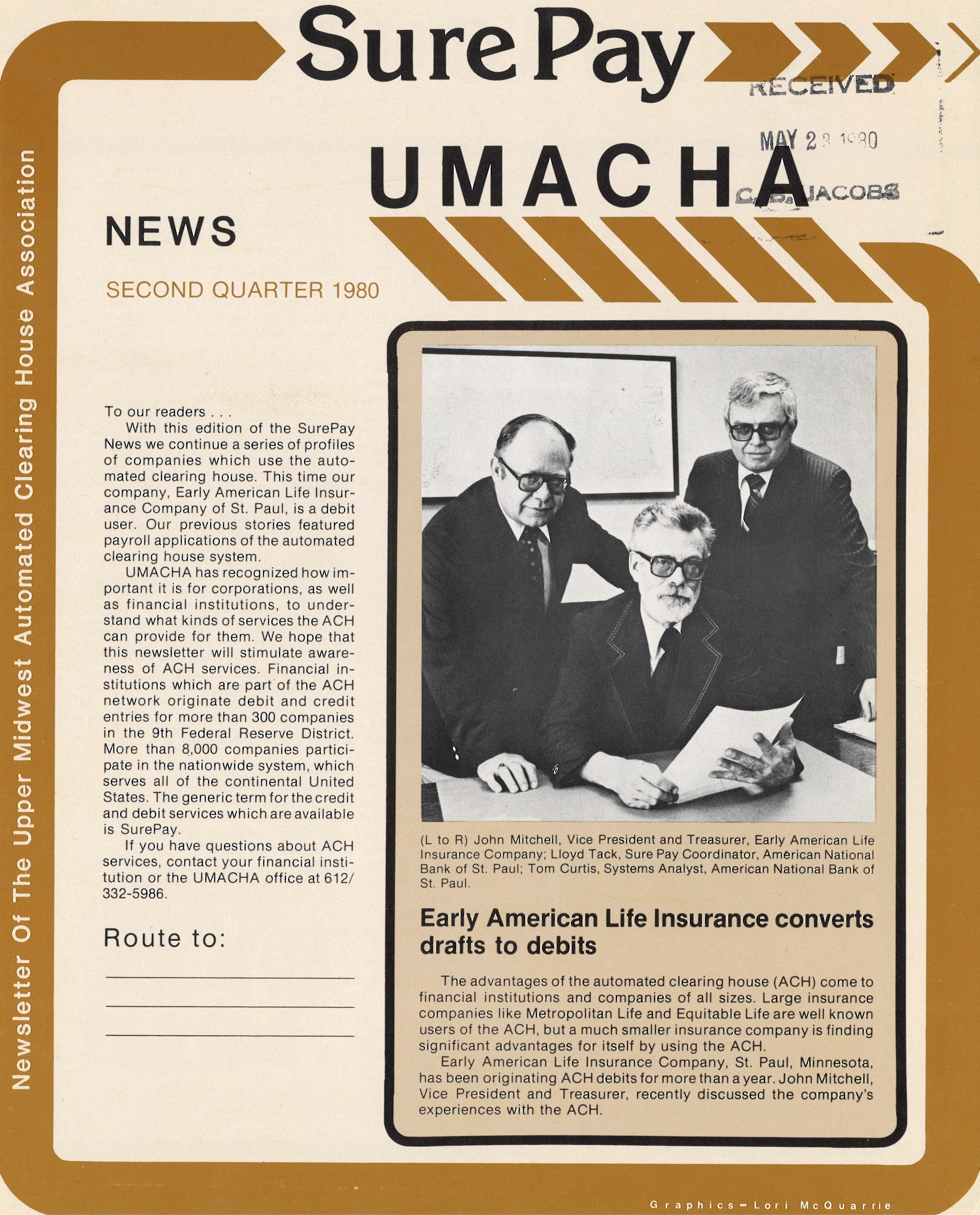

Page 1 of the May 1980 newsletter

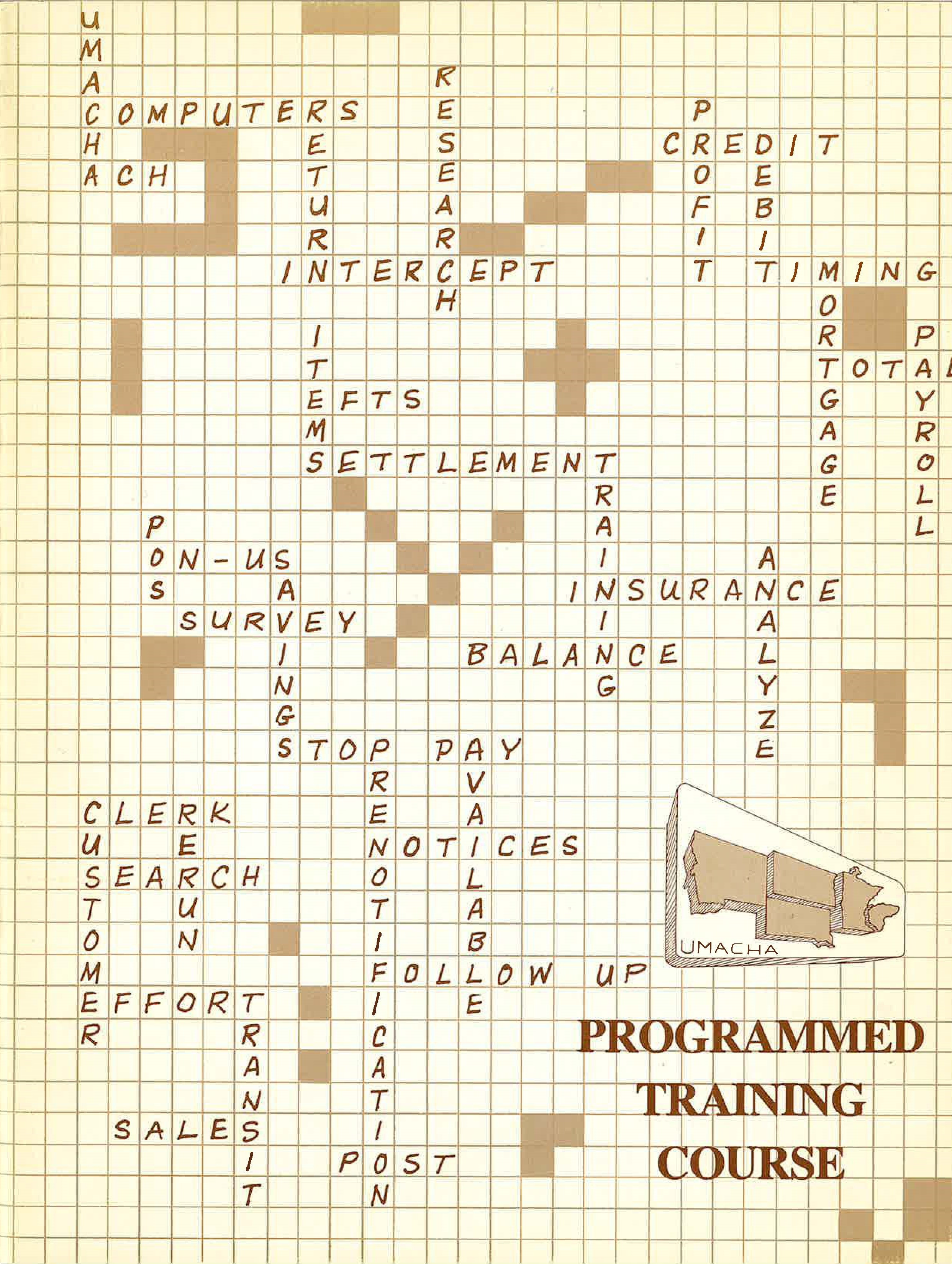

1980s Program Training Course Catalog Cover

Page 1 of the Q3 1981 newsletter

1981: UMACHA's first official logo highlighting the Ninth District of the Federal Reserve

February 1985 newsletter announcing Fred Laing II's hiring as UMACHA's second Executive Director

1985 - 1989 brochures for UMACHA's annual ACH Marketing Conference

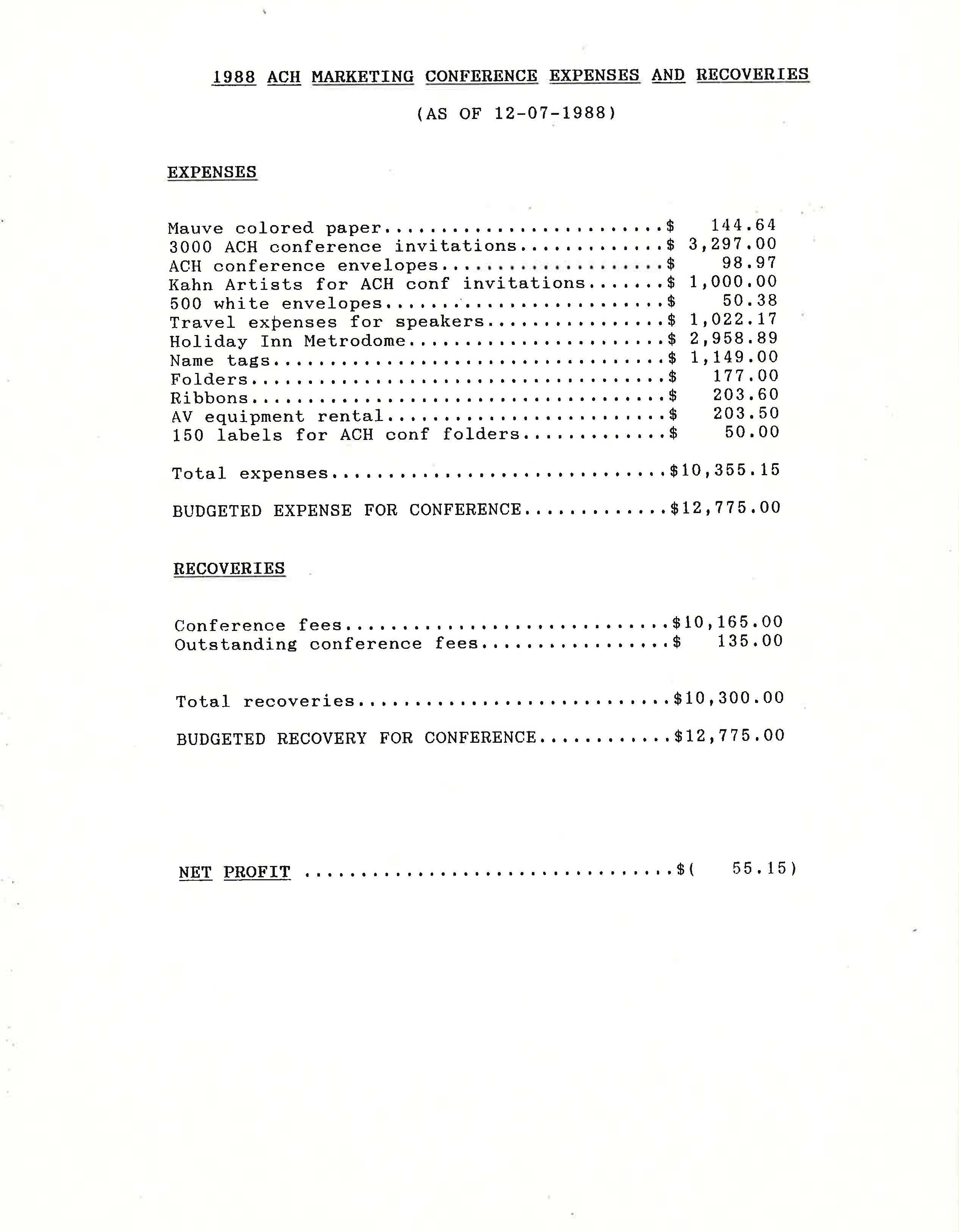

Budgetary document for the 1988 Marketing Conference