UMACHA & the 1990s

Number of Employees: 4

The 1990s were a prosperous decade marked by significant technological advancements. The rise of the information superhighway simplified communication and connection across the globe, creating new opportunities for businesses and entrepreneurs and driving innovation and investment into the tech space. However, the digital divide became an immediate concern, creating a gap between those with internet access and those without.

In addition to the internet, other technologies such as mobile phones, personal computers, and digital media saw significant advancements. The popularity of video games grew rapidly with the advent of platforms such as Sony PlayStation, Sega Saturn, and Nintendo 64. Google and Amazon also launched during this decade. The 1990s ended with much concern about the Y2K bug.

The 1990s left its mark on popular culture. It was a time of great creativity and innovation, marked by the rise of alternative rock and hip-hop music, the advent of grunge fashion, and the immense popularity of blockbuster movies like Titanic, and TV shows like Friends and Seinfeld.

The end of the Cold War had left Russia in chaos, and China was recovering from terrible leadership. This instability allowed the United States to rise as the world's sole superpower, ushering in a stellar economy characterized by low inflation, declining unemployment rates, and rising productivity. America was not the only country to benefit from spreading globalization and economic prosperity, as international trade increased with the establishment of the European Union (EU) in 1993, the North American Free Trade Agreement (NAFTA) in 1994, and the World Trade Organization (WTO) in 1995.

The banking industry saw significant consolidation during this decade, with ten FDIC-insured savings banks failing in 1990 alone — more than the previous seven years combined. By the 2000s, five investment banks dominated the United States. However, these consolidations had little effect on the high consumer confidence of the time.

Overall, the 1990s were considered good years, with inflation and unemployment rates falling, and the global economy and community becoming more connected than ever.

1990

UMACHA begins offering classes on check basics, wire transfer and cash management.

1991

UMACHA rolls out a fax on-demand service so members can easily get forms, sample contracts, and other useful information at any time.

Up to this point, UMACHA’s only real focus was Education.

UMACHA's commitment to member services shows itself in the early 90s with the roll-out of an 800 number that members can call when they have a question or an issue.

1992

Nacha Rule Amendment: Self-Audit Procedures

- Effective April 3, 1992

- This change provided the requirements for a compliance audit and defined the minimum specifications for a periodic review of a financial institution’s compliance with the NACHA Operating Rules.

1993

Accredited ACH Professional (AAP) Program launches.

New SEC Code = XCK (Destroyed Check Entries)

Nacha Rule Amendment: Destroyed Check Entries

- Effective April 2, 1993

- This amendment created a new Standard Entry Class Code, XCK, for the transmission of Destroyed Check Entries over the ACH Network.

The ACH network becomes all-electronic.

Nacha Rule Amendment: Rule Changes Necessary for an All-Electronic Environment

- Effective July 1, 1993

- This change removed references to paper and/or tape-based procedures from the Rules.

1995

UMACHA member dues changed to be based on ACH originated and received volume.

Members signed participation agreements with the Federal Reserve Bank of Minneapolis to allow UMACHA access to their ACH volume.

1996

Nacha Rule Amendment: Elimination of CTP

- Effective 1996

- This rule change eliminated the use of the CTP format over the ACH Network in 1996.

Nacha Rule Amendment: ODFI Exposure Limits

- Effective September 1996

- This rule required an ODFI to establish exposure limits for each of its corporate Originators prior to the origination of credit and debit entries for that Originator. The threshold must be reviewed periodically and monitored over multiple settlement dates. This rule also modified the NACHA self-audit rules to require an ODFI to review compliance with these requirements in its self-audit procedures.

Nacha Rule Amendment: Optional Prenotification

- Effective September 1996

- This rule amendment made the initiation of prenotification entries optional for all Standard Entry Class Codes and payment types, both credits and debits.

1997

Manpower offers the PayTM Card, the first Payroll Card granting access to wages via POS or ATM, due to lower-than-expected adoption of Direct Deposit.

UMACHA launches its first website – www.umacha.org

- Click here (off site) to see what UMACHA's website looked like in the late 90s.

An ACH Kit for UMACHA members to train their own staff debuts.

1998

UMACHA begins accepting dues via ACH.

Bylaw change eliminates board slot held for S&Ls (savings and loans) as number of S&L members dwindles to under 10.

Nacha Rule Amendment: Enforcement Issues

- Effective December 18, 1998

- This rule amendment included a national system of fines within the NACHA Operating Rules to help alleviate compliance problems in the ACH Network through the imposition of fines.

1999

All government payments must be made electronically.

UMACHA offers teleseminars and in-person training.

Annual ACH Audit Rule goes into effect (was previously required every 3 years).

Nacha Rule Amendment: Compliance Issues

- Effective December 17, 1999

- This rule amendment amended the NACHA Operating Rules governing Rules Compliance Audit Requirements as follows:

- Annual Audits of Rules Compliance

- Greater Coverage of Rules Provisions Within the Self-Audit Provisions

- Completion of Self-Audit by Third-Party Service Providers

- Retention of Documentation by Depository Financial Institutions and Third-Party Service Providers That Self-Audit Has Been Completed

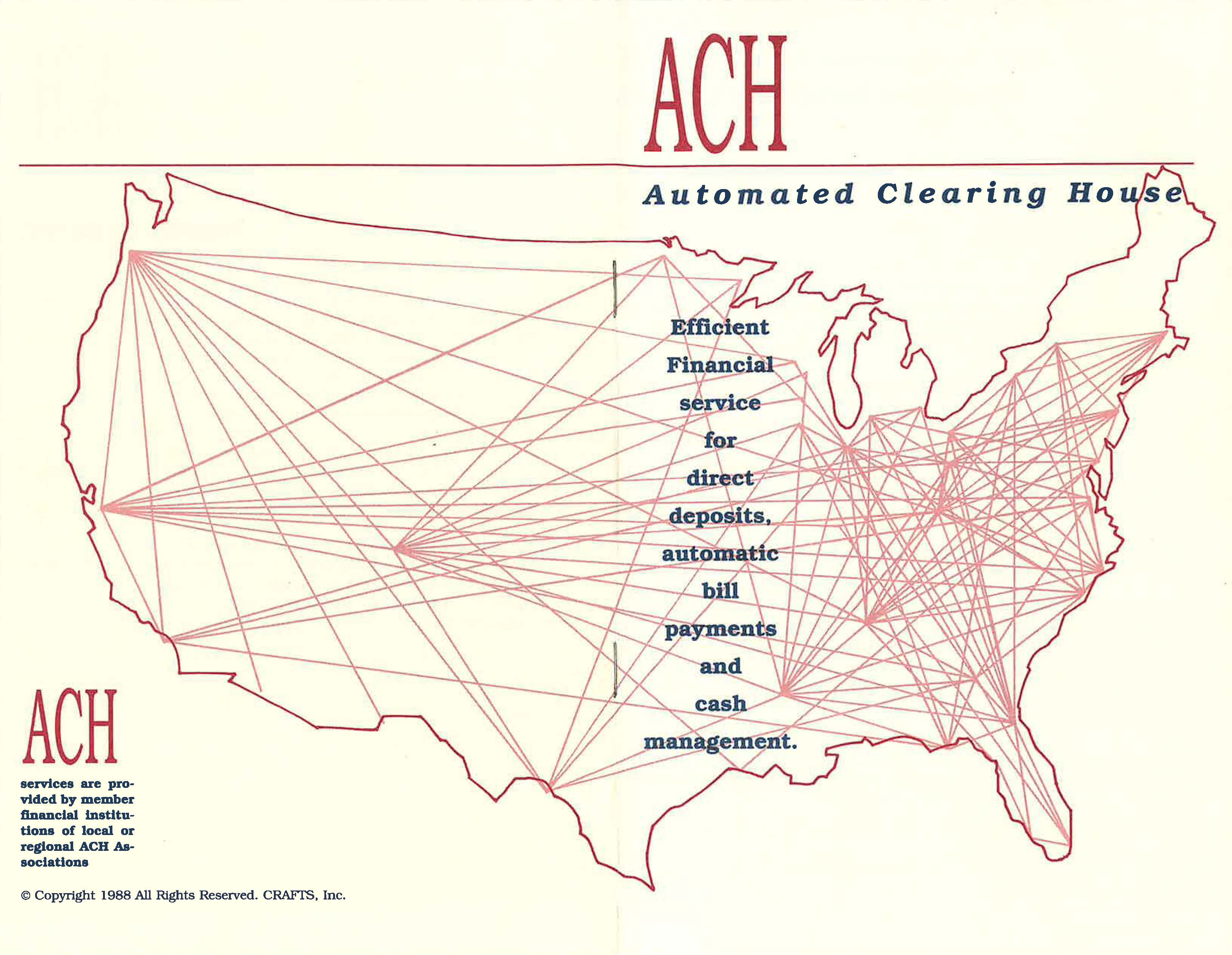

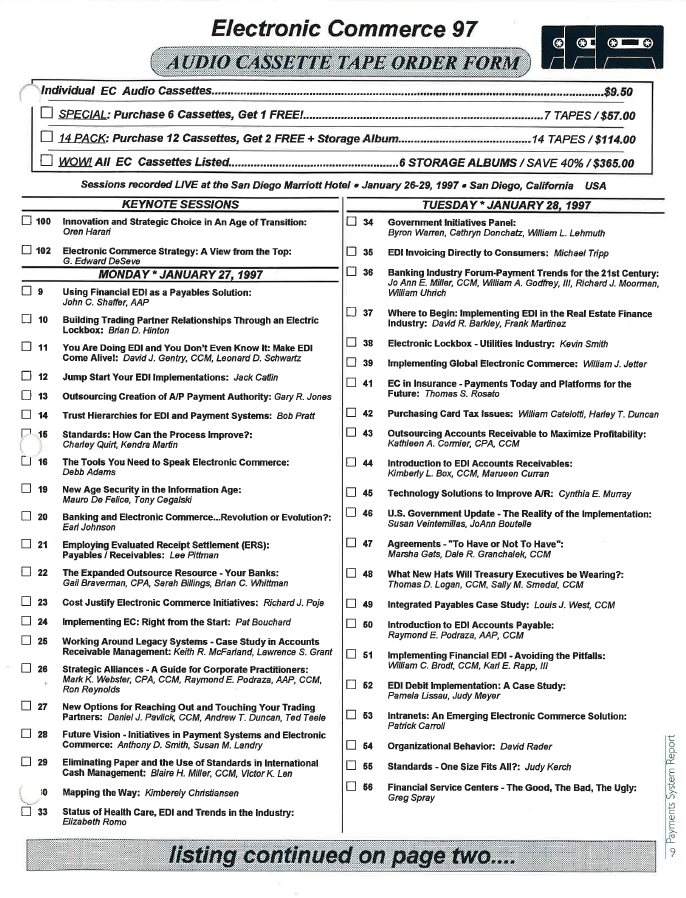

Click an image to expand to full screen.

1991 - 1999 brochure covers for UMACHA's annual Marketing/Electronic Payments Conference

1990 brochure on the benefits of ACH adoption

1990: UMACHA's second official logo

1991 UMACHA ACH seminars brochure

Some of the first UMACHA-produced publications across the 1990s

Order form to purchase audio cassettes from a 1997 conference

1997 Nacha brochure highlighting materials for purchase to promote ACH usage

TV actress Lindsay Wagner helping promote the adoption of Direct Payment & bill pay - 1998

Summary document of PSA commercials ran in 1998 featuring film actor Ricardo Montalban helping promote the adoption of Direct Deposit for Social Security benefits

1999 brochure on the benefits of filing tax returns electronically using ACH

1999 brochure titled 'An Employer's Guide to Direct Deposit'