UMACHA & the 2000s

Number of Employees: 7

The 2000s were marked by significant political events globally. In the United States, the decade began with the controversial presidential election of 2000, culminating in the Supreme Court decision in Bush v. Gore. The September 11, 2001 terrorist attacks reshaped international politics, leading to the War on Terror and military interventions in Afghanistan and Iraq. The decade also saw the rise of social media as a political tool, with platforms like Facebook and Twitter influencing political discourse and activism.

Economic turbulence marked the 2000s with both booms and busts. It began with the bursting of the dot-com bubble in 2001, which triggered a recession. However, amidst this downturn, the housing market surged due to aggressive subprime lending practices, eventually climaxing in the global financial crisis of 2007-2008. The collapse of major financial institutions like Lehman Brothers reverberated worldwide, causing widespread unemployment and necessitating government interventions to stabilize financial markets.

The 2000s were a vibrant era in pop culture. Reality television gained popularity, while blockbuster films like the "Harry Potter" and "Lord of the Rings" series captivated audiences. The rise of digital music and the introduction of the iPod revolutionized the music industry, while social media platforms like MySpace, and later Facebook, transformed the way people connected and shared content online.

Technology made massive leaps during this decade. The rise of broadband internet led to increased connectivity and the proliferation of online services like streaming video and e-commerce. Google and Amazon became household names, revolutionizing search and online shopping. The introduction of smartphones, led by the release of the iPhone in 2007, transformed how people communicated and accessed information, laying the groundwork for the mobile-centric world of the 2010s and beyond.

2000

New SEC Codes = RCK (Represented Check Entry), CBR/PBR (Corporate Cross-Border Payment/Consumer Cross-Border Payment)

Nacha Rule Amendment: Change Implementation Date: RCK

- Effective September 15, 2000

- This amendment changed the implementation date for the PPD interim rule to September 14, 2000 and delayed the implementation date of the RCK rule to September 15, 2000.

Nacha Rule Amendment: Change Implementation Date: CBR/PBR

- Effective September 15, 2000

- This amendment delayed the implementation date of the Cross Border SEC Codes until September 15, 2000.

2001

EFTPS (Electronic Federal Tax Payment System) launches.

39 million citizens receive their tax refunds electronically via direct deposit.

New SEC Code = WEB (Internet-Initiated Entry) & TEL (Telephone-Initiated Entry)

Nacha Rule Amendment: Internet-Initiated Entries (WEB)

- Effective March 16, 2001

- This rule amendment created a new Standard Entry Class Code, WEB (Internet-Initiated Entry), to specifically identify consumer ACH debit transactions initiated via the Internet.

Nacha Rule Amendment: Telephone-Initiated Debit Entries (TEL)

- Effective September 14, 2001

- This rule amendment implemented a new Standard Entry Class (SEC) Code, TEL (Telephone-Initiated Entry), to facilitate the transmission of single-entry ACH debits that are initiated based on an oral authorization obtained from a Receiver via the telephone.

2002

New SEC Code = ARC (Accounts Receivable Entry)

Nacha Rule Amendment: Electronic Check Applications

- Effective March 15, 2002

- This rule amendment modified the Rules to:

- create a new Standard Entry Class Code, ARC (Accounts Receivable Entry), that would specifically identify Single-Entry consumer ACH debit transactions for the conversion of consumer checks provided to the Originator via a lockbox facility or at a dropbox location.

- eliminate the retention requirements related to the original check for Re-presented Check Entries (RCK).

- add two return reasons for RCK entries and two return reasons for POP entries to be consistent with return reasons being implemented for ARC.

2003

Nacha Rule Amendment: Rules Compliance Audit Requirements

- Effective March 14, 2003

- The rule amendment updated the ACH rules compliance audit requirements in Appendix Eight of the NACHA Operating Rules by:

- Clarifying that the audit provisions do not prescribe a specific methodology to be used for the completion of such an audit, but identify key rules provisions that should be examined during the audit process.

- Adding requirements to the existing audit rules for RDFIs (and any third-party service providers that process on behalf of RDFIs).

- Adding requirements to the existing audit requirements for ODFIs (and any third-party service providers that process on behalf of ODFIs).

2004

UMACHA's Audit Department forms to assist members with compliance issues.

Nacha Rule Amendment: ACH Data Security Requirements

- Effective September 10, 2004

- This rule change expanded data security requirements within the Rules to require all ACH transactions, regardless of Standard Entry Class (SEC) Code, that involve the exchange or transmission of banking information via Unsecured Electronic Networks to be either (1) encrypted using a commercially reasonable security technology that, at a minimum, is equivalent to 128-bit RC4 encryption technology, or (2) transmitted via a secure session utilizing a commercially reasonable security technology that provides a level of security that, at a minimum, is equivalent to 128-bit RC4 encryption technology. This amendment also defined an Unsecured Electronic Network.

UMACHA gives www.umacha.org a fresh new look, improving the website's functionality for its Members.

2006

OCC Bulletin 2006-39 was released on September 1, 2006 and was the first time a Financial Institution regulatory body issued Risk Management Guidance on Automated Clearing House Activities. This bulletin outlines the key components of an effective ACH risk management program and helped pave the way for ACH risk management Rules to be developed in our ACH Network.

2007

New SEC Code = BOC (Back Office Conversion)

Nacha Rule Amendment: Back Office Conversion Using New BOC SEC Code

- Effective March 16, 2007

- This amendment created a new SEC Code and formatting requirements for the transmission of back office conversion entries.

IAT (International ACH Transactions) approved to replace CBR & PBR (goes into effect in 2009).

2009

UMACHA begins performing RDC (Remote Deposit Capture) Risk Assessments.

New SEC Code = IAT (International ACH Entry) to replace CBR & PBR

Nacha Rule Amendment: International ACH Transactions (IAT)

- Effective September 18, 2009

- This amendment required ODFIs and Gateway Operators (which may be Participating DFIs and ACH Operators) to identify all international payment transactions transmitted via the ACH Network as International ACH transactions using a new Standard Entry Class (SEC) Code – IAT. This amendment also required IAT payments to include specific data elements defined within the Bank Secrecy Act’s Travel Rule, so that all parties to the transaction have the information necessary to comply with U.S. law, including sanctions programs administered by the Office of Foreign Assets Control (OFAC).

Risk Management & Assessment Rule goes into effect.

Nacha Rule Amendment: Rules Audit Enhancements

- Effective December 18, 2009

- The Rule refined and clarified existing Rules compliance audit requirements; included additional provisions to provide a more robust set of audit criteria; and provided additional guidance for ODFIs, RDFIs and their Third-Party Service Providers.

Click an image to expand to full screen.

2000 - 2009 brochure covers for UMACHA's Electronic Payments Conference, first referenced as 'Navigating Payments' in 2004

2000 - 2009 ACH Rule Books w/ UMACHA logos

December 2000 UMACHA newsletter highlighting Nacha's approval of the WEB SEC Code

2002 ACH Direct Payment brochure

2003: UMACHA's third official logo

Nov/Dec. 2004 UMACHA newsletter notifying members of UMACHA's new & improved website

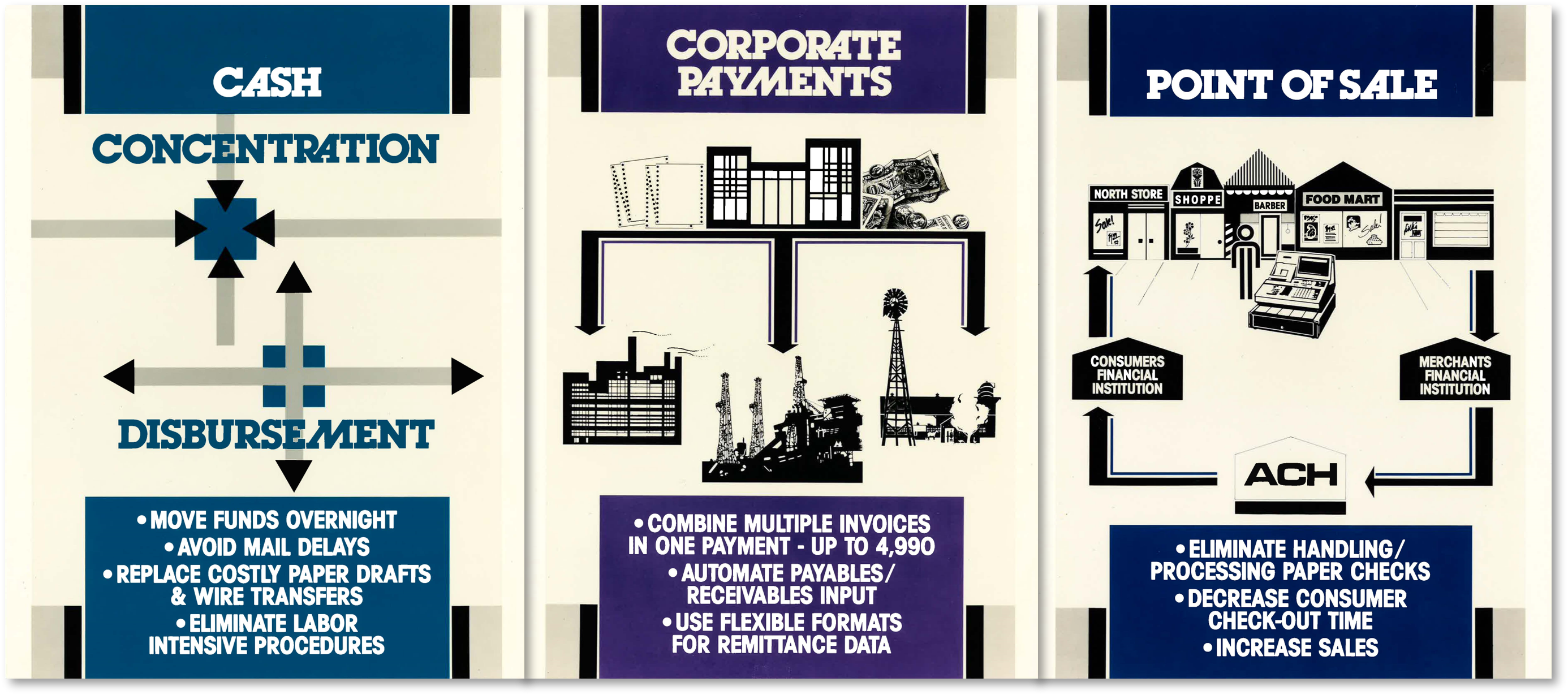

2006 window clings highlighting the benefits of ACH utilization for corporates

2007 promotion for ACH Direct Deposit

2008: Federal Reserve promoting their Fed ACH service

L to R: Casey Wilcox, former UMACHA President Fred Laing II, Mary Gilmeister, President of MACHA, at Navigating Payments 2008

Fred Laing II addressing attendees at Navigating Payments 2008

2009 industry event at Beaver Creek Resort

Back row - L to R: Unknown, Unknown, Lynne Laing, Fred Laing II, Nadia Kozak

Front row - L to R: Mike Murphy, Trevor Francis, Brian Geisel, Jane Larimer, Mary Gilmeister, Paul, Gilmeister, Koichi Kurata